You can expect a couple of things to happen pretty much every January: Freight rates will fall, and some will overreact.

You don't have to look hard to find doom and gloom prognostications, but I've actually seen three big trends in the last month of DAT freight data to indicate a more positive outlook on freight conditions. While rates dropped sharply in many markets last month, spot market volumes have held up better than some observers expected.

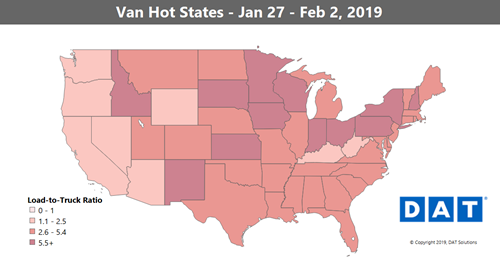

1. Van volumes held steady last month compared to December, and DAT RateView submissions for last month were slightly above January 2018 levels. Van load counts jumped up 6% last week, with strong volumes out of two powerhouse markets: Atlanta and Los Angeles.

2. Winter weather can introduce volatility. Chicago outbound rates rose 6% last week with no increase in volumes. That's a huge jump for the winter, and it was due largely to capacity shortfalls during the brief blast of arctic weather. Load-to-truck ratios rose sharply in the Midwest and Northeast, as carriers in the storm zone were not motivated to post their trucks.

3. Volume changes often precede spot rate adjustments, and the delay can take up to a week. Brokers may be aware of changes in demand immediately, but the trucking community may not detect the shift in market conditions for 2 or 3 days. (The exception is refrigerated produce, where truckers change their pricing within hours.)

Flatbed freight rebounds

Meanwhile, flatbed rates held up better than van and reefer rates in January. The flatbed market bottomed out in November along with oil prices. Oil is now on the rebound, and the flatbed market is poised for a strong spring.

January also saw a strong rebound in the Purchasing Managers Index (PMI) report from the Institute for Supply Management (ISM), indicating continued growth in the manufacturing sector. If you follow flatbed rate trends in DAT RateView, that shouldn't be a huge surprise, because the industrial economy and flatbed freight are closely correlated.

Freightliner’s Team Run Smart is partnering with DAT to offer a special on the TruckersEdge load boardto its members. Sign up for TruckersEdge today and get your first 30 days free by signing up at www.truckersedge.com/378402 or entering “promo717” during sign up.

* This offer is available to new TruckersEdge subscribers only

About TruckersEdge®, powered by DAT®

TruckersEdge® Load Board is part of the trusted DAT® Load Board Network. DAT offers more than 68 million live loads and trucks per year. Tens of thousands of loads per day are found first or exclusively on the DAT Network through TruckersEdge.

This article was originally featured on DAT.com. Opinions Expressed are not those of Daimler Trucks North America.