Congress passed the 2-trillion-dollar “Coronavirus Aid, Relief, and Economic Security Act” or the CARES Act. This legislation includes public health spending, lending programs for small businesses, and a cash payment to citizens. There is also relief for hard-hit industries. I will be focusing on how this will affect Company Drivers that file a W2 tax return.

Congress passed the 2-trillion-dollar “Coronavirus Aid, Relief, and Economic Security Act” or the CARES Act. This legislation includes public health spending, lending programs for small businesses, and a cash payment to citizens. There is also relief for hard-hit industries. I will be focusing on how this will affect Company Drivers that file a W2 tax return.

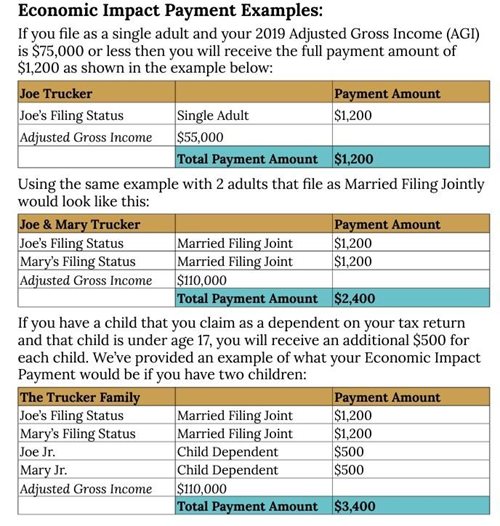

How Much Will I Get?

This all depends on your filing status from 2018 or 2019 if you have already filed that. The payment is set up as an advance on a tax credit for your 2020 tax return. The amount will be determined by the following guidelines

- Single: $1200

- Married Filing Jointly: $2400

- Each Qualifying Dependent Under Age 17: $500

There is a Phase-out of $5 for every $100 above the Adjusted Gross Income above these amounts

- Single Filers: $75,000+

- Head of Household Filers: $112,500+

- Married Filing Jointly Filers: $150,000+

If you are above the following levels you will be phased out completely

- Single Filers: $99,000+

- Head of Household Filers: $136,500+

- Married Filing Jointly: $198,000+

For each eligible child, the phase-out limits will be increased by $10,000

Payment Qualifications

The payment amount will be based on your adjusted gross income from 2018 or 2019. Since this is an advance tax credit for your 2020 returns, if you are due a higher payment you can file for that on your return. It appears if your payment is more than you should receive in 2020, the IRS will allow you to keep the payment without penalty, nor will you need to repay opt. Keep informed on this, however. It could change. Here are the qualifications to receive the payment.

- You must be a citizen or a resident alien

- You must have a social security number as well as the children.

- You cannot be eligible to be claimed as an independent

- Estates and Trusts do not qualify

When Can I Expect Payment?

According to the IRS, they will begin distributing mailed checks around April 21, 2020, if you have filed your 2018 or 2019 taxes. If you haven’t filed your return for 2018 or 2019 The IRS will send your check AFTER you file your return. If you have used electronic payment with the IRS before the money will be sent directly to your account. If you do not have direct deposit set up, in the coming weeks the Treasury will be developing a web-based access point for people to provide their banking information to the IRS so they can receive this payment directly instead of through the mail as a check.

These are crazy times we are living in and I hope this info helps. If you have more questions or are an owner/operator, lease operator, or fleet owner there is more information in a free E-Book at ATBS.com

Follow Team Run Smart Pro Clark Reed on Facebook, Instagram and Twitter.