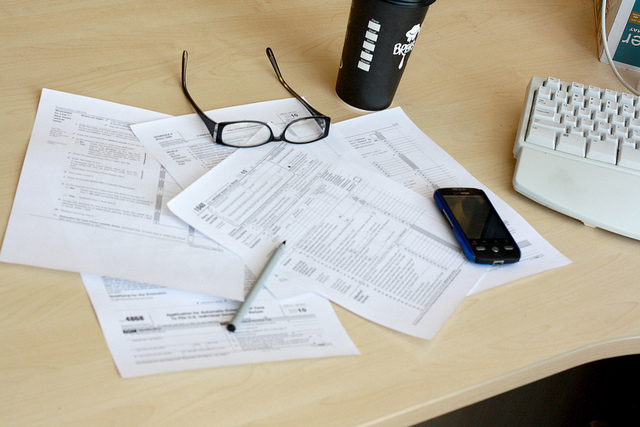

You may be eligible to claim the premium tax credit on your 2015 income tax return. The premium tax credit helps eligible individuals and families with low or moderate income afford health insurance. Millions of people who purchased their coverage through a health insurance Marketplace are eligible for premium assistance through the premium tax credit, which individuals chose to either have paid upfront to their insurers as advance payments to lower their monthly premiums or receive when they file their taxes.

If you received the benefit of advance credit payments, you must file a federal tax return and reconcile the advance credit payments with the actual premium tax credit you are eligible to claim on your return. Failing to file your tax return to reconcile advance payments will prevent you from receiving advance credit payments in future years.

You will use IRS Form 8962, Premium Tax Credit (PTC) to make this comparison and to claim the credit. If your advance credit payments are in excess of the amount of the premium tax credit you are eligible for, based on your actual income, you must repay some or all of the excess when you file your return, subject to certain caps.

Also Read: Do You Have Qualifying Coverage Under The Health Care Law

If you or anyone on your tax return enrolled in health coverage through the Health Insurance Marketplace, you should receive Form 1095-A, Health Insurance Marketplace Statement from your Marketplace form by early February. Use the information from Form 1095-A to file your taxes accurately. This information includes the name of your insurance company, dates of coverage, amount of monthly insurance premiums for the plan you and other members of your family enrolled in, amount of any advance payments of the premium tax credit for the year, and other information needed need to compute the premium tax credit.

If you need additional questioned answered about the premium tax credit, make sure you talk to a qualified accounting firm like ATBS.

Image Source - https://www.flickr.com/photos/moneyblognewz/