When it comes to money, the idea of saving for retirement can be overwhelming for some people. Fortunately, there are small steps you can take along the way to alleviate the pressure of achieving such a lofty financial goal. Knowing where to park your money for the long haul and how to find more of it to invest isn’t as difficult as you might imagine.

So if you’re envisioning a retirement filled with hours on the golf course and margaritas on the beach, stick with me, because I’m going to walk you through some creative ways you can boost your retirement savings today so that you can live a fabulous life tomorrow. Let’s do this.

Take Advantage Of Tax-Advantaged Accounts

If you’re not familiar with the term, tax-advantaged, when it comes to retirement accounts, you need to be.

Tax-advantaged means the investment is either tax-reduced, tax-deferred, or tax-free. All of which play a vital role in the amount of money you will eventually be able to get your hands on in the future - when you need it most.

Here are the benefits for each type of tax advantage:

Tax-reduced: Investing into an Individual Retirement Account, also known as a IRA, can mean big tax breaks when April 15th rolls around. Why? Because you can deduct your contributions from your taxable income.

Tax-deferred: The ever popular employer-sponsored 401(k) account is the quintessential tax-deferred retirement savings vehicle. Investing into a 401(k) or equivalent means you could be earning money on pre-tax dollars for decades before having to withdrawal and pay taxes. And hopefully, by then, you’ll be in a lower tax bracket.

Tax-free: This is pretty much self-explanatory. When an investment is tax-free, you don’t pay any taxes on it. An example is a Health Savings Account, also known as a HSA. Following the rules of a HSA plan will result in not paying any tax on withdrawals, including the gains.

Retirement Investment Vehicles To Stash Your Cash

As mentioned above, there are quite a few vehicles you can use to invest for your retirement. See below for a rundown:

- 401(k): Employer-sponsored retirement plan that often comes with a percentage of matching contributions from the employer and allows for tax deferment until withdrawal.

If you don’t have access to a 401(k), you can use individual accounts:

- Traditional IRA: Contributions can be deducted from federal and state taxes within the current year. Taxes are paid upon withdrawal at ordinary income tax rate.

- Roth IRA: Individuals meeting certain income requirements can participate in a Roth IRA. This type of IRA allows for contributions to be made with after-tax dollars. Withdrawals made after 59 ½ are tax-free.

Ineligible Income Limits for 2018: $135k for single filers and $199k for married filers

- SEP IRA: Also known as a Simplified Employee Pension, is a way for self-employed individuals and small business owners to participate in a retirement savings vehicle with tax advantages that mimic a traditional IRA.

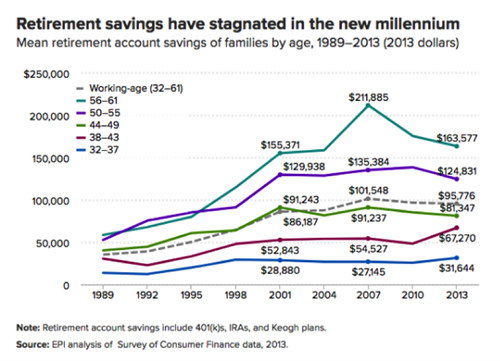

Average Retirement Savings

I know this probably isn’t your favorite topic, but if you think saving for retirement isn’t important, I highly recommend checking out the infographic below.

Unfortunately, based on this information, the majority of families in this country are not likely to be comfortable in their golden years. To avoid such a situation, you need to take action now.

Infographic Source: CNBC

5 Creative Ways To Boost Your Retirement Savings

Now that you know about the benefits of tax-advantaged retirement accounts and you know the various vehicles to choose from, let’s explore five creative ways you can increase your retirement savings without even missing the money.

1. Start Today

No question about it, starting young is the absolute BEST time to start saving for retirement. The second best time is today. Since the power of compounding works best with plenty of years in the equation, start today to reap maximum returns.

2. Increase Your Savings Rate Each Time You Get A Raise

Most people get raises at least once per year. If you happen to fall into this category, you should consider taking the entirety of your raise - or at least a portion of it - and direct it to retirement savings. If you don’t allow yourself to get used to having the additional money, you’ll never miss it.

3. Set Up Automatic Contributions

Most retirement investments allow for automatic contributions. If you’re working with an employer-sponsored account, you’ll be able to sign up for deductions to be made directly from each paycheck.

If, however, you’re investing into a IRA, your automatic contributions will need set up to be pulled directly from your bank account after your paycheck has been deposited.

Either way, automatic contributions equals Set It And Forget It. Personally, this is my favorite way to invest.

4. Invest Found Money

Found money is money you weren’t expecting to have in the first place. Found money can be anything from mom and dad sending you some birthday cash, a 20-dollar-bill you found stashed in an old winter coat, or a rebate check from the purchase of a new appliance.

Remember the old saying, every little bit helps? Well, turns out it’s true. Sure, 20 dollars here and 50 dollars there doesn’t seem like much, but add it up over the course of a year and you might be looking at an extra 500 dollars invested to help fund a comfortable retirement.

5. Cut Expenses And Increase Contributions

Every little bit helps. If you can trim the fat here or there on various monthly expenses, you can take the savings and throw it into your retirement savings.

Think: cable, phone, groceries, gas, utilities, entertainment, etc.

And there you have it. A quick and dirty list of five creative ways to boost your retirement savings without missing the money.

The sooner you implement some of these strategies, the sooner you’ll be able to relax and enjoy your life without having to stress over not having a plan for your older, more mature self. Now, go forth and save.