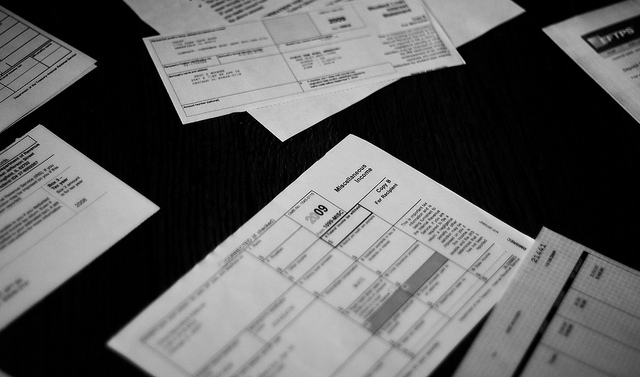

Many professional truck drivers choose to contract their services to carriers and fleets. The 1099 is a tax form which allows the IRS to track any payment a company gives to independent contractors for their services.

Where is my form 1099-MISC

Form 1099-MISC is commonly issued to professional drivers. This form should have been issued to all independent contractors by January 31, 2015. This puts the responsibility on the carrier or fleet to provide the 1099 form to its contractors. Even if you do not receive the 1099, you will still need to report the income on your taxes by April 15, 2015.

Tracking Down Form 1099

If you have trouble tracking down this form from your fleet, there are several things you can do. First, you can give the fleet or carrier a call. Typically, Form 1099 is issued by the same group that handles your paycheck every week or month. Be sure to track this information down at the beginning of February so you are ready to submit your forms and paperwork to your tax preparer in order to file on time.

Second, you can ask the IRS for older 1099s and they can typically supply this documentation for the past 10 years. To make this request, you will need to complete Form 4506-T. The good news is that this service is free.

Finally, at the very least, you can estimate your 1099-MISC income. Do so by reviewing your year-end pay stubs issued by your fleet or carrier. A simple amendment process is available if you overestimated your income. Remember, the IRS does not like it when you underestimate earnings and may impose penalties for doing so.

ATBS clients have their income reported or downloaded every month so the tax filing process is streamlined. The Tax Organizer walks ATBS clients through the tax process and ensures every owner-operator tax deduction is considered.

Issuing a 1099

Some independent contractors will pay others to help them run their business. If you paid someone more than $600 in 2014, then you will need to file a 1099 for that person and send a copy of this to the IRS by February 28th [or March 31st if you file electronically].

A good bookkeeping practice to adhere to is filing a signed and completed W-9 for each contractor you hire. This provides the information you need for filing Form 1099 with your contractor and the IRS.

Conclusion

Form 1099 is an important element in every independent contractor’s life. February is the time to organize your paperwork and hand this over to a professional tax preparer.

Image Source - https://www.flickr.com/photos/reallyboring/