Tax credits can significantly reduce the amount you owe in taxes, so make sure your tax preparer is taking advantage of credit savings on your tax return. Below are the family and education credits you may be eligible for:

Child and Adoption Credits

For each qualified dependent you are claiming on your tax return under the age of 17, you may be able to reduce your tax by a $1000 child tax credit.

You may be able to take a tax credit of up to $12,970 in qualified expenses paid to adopt each eligible child. The credit may be taken for the adoption of a child with special needs even if you did not have any qualified expenses. You can use the maximum credit of $12,970 to reduce any tax liability owed, but the excess will not be refunded.

Child Care Expenses

You may be able to claim the credit for child and dependent care expenses. To qualify for this credit both you and your spouse must have earned income during the year and the child must be a qualified dependent under the age of 13. The maximum expense for each dependent is $3000.

Flexible Spending Account (FSA)

You may make a $5000 maximum pre-tax contribution for dependent care expenses. This allows you to exclude the contribution made during the year from your salary to cover dependent care expenses through an FSA.

Kiddie Tax

Part of a child’s 2013 unearned income more than $2000, such as dividends and interest, may be taxed at the parent’s tax rate. This is for children under the age of 19 or a full-time student under the age of 24 who does not earn any income.

529 Plans

This program allows you to either prepay or contribute to an account to pay for a student’s qualified higher education expense at an eligible educational institution.

- Tax-free as long as they are used to pay for qualified higher education expenses.

- Distributions can be used for tuition, required fees, books, supplies and room and board.

- There are no income limit contributions.

- No age limits. Open to adults and children.

- The contributor of the account has control, not the student.

- There is no federal limit on the number of changes you make if you replace the student’s account with another qualifying family member at the same time.

- You can make a five year upfront deposit of $70,000 for the annual gift tax exclusions.

Be aware that your investment options may be limited when making changes to them.

Education Credits and Deductions

You may be able to deduct qualified education expenses and student loan interest paid during the year for you, your spouse or qualified dependent.

American Opportunity Credit

This credit is the most valuable education credit. Your credit is 100% of the first $2,000 spent on tuition plus 25% of the next $2,000. The total that can be claimed for one student is limited to $10,000 ($2,500 for four years). If this credit is not extended by Congress, it will expire at the end of 2017 tax year.

Lifetime Learning Credit

This credit helps parents and students pay for post-secondary education (grad school and night school tuition). You may be able to claim a lifetime credit of up to $2,000 per tax return on the first $10,000 spent on college tuition expenses. There is no limit on the number of years the lifetime learning credit can be claimed for each student.

Tuition and Fees Deduction

You may be able to deduct education expenses paid during the year for you, your spouse or your qualified dependent. The tuition and fees deduction can reduce the amount of your income subject to tax by up to $4000. This credit can be taken if you are not eligible for any of the other credits due to high income.

Student Loan Interest

This deduction is available when you are paying off a student loan. You are eligible to deduct up to $2,500 of interest per tax return. The student loan interest deduction is taken as an adjustment to income.

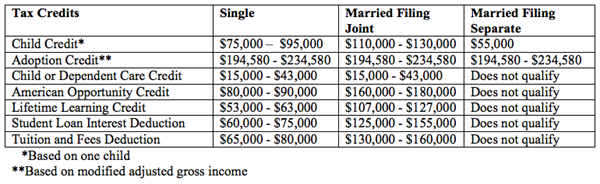

Please Note: Most credits are subject to phase out limitations for higher income taxpayers. See chart for phase out limitations.

2013 AGI Phase-Out Amounts