It takes a lot of money to operate these big pieces of machinery that we have to day in and day out. With higher average expenses than a large majority of other types of businesses, it is no wonder why NASTC estimates that nearly 15% of small start-up trucking companies fail before completing their second year of business (newauthoritytraining.com). Do not let this rather alarming figure fool you into believing that there’s no money to be made in trucking these days, which can easily be heard in your average truck stop fodder. In smartly planning for the unexpected, you will easily be one step closer to running your business successfully.

It takes a lot of money to operate these big pieces of machinery that we have to day in and day out. With higher average expenses than a large majority of other types of businesses, it is no wonder why NASTC estimates that nearly 15% of small start-up trucking companies fail before completing their second year of business (newauthoritytraining.com). Do not let this rather alarming figure fool you into believing that there’s no money to be made in trucking these days, which can easily be heard in your average truck stop fodder. In smartly planning for the unexpected, you will easily be one step closer to running your business successfully.

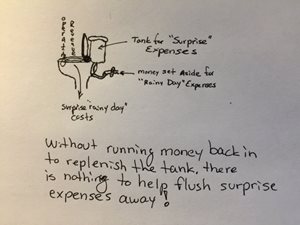

One major key to succeeding is identifying, planning for, and managing large expenses. These expenses come in two general forms of those that you know an exact date you will incur them and the other category of “surprise” expenses. Even though I label one category as “surprise” expenses, you can be certain many of these surprises can be planned for ahead of time as well. Knowing exactly what your expenses are and being prepared for them can easily mean the difference between success and belly-up. It is all too often I run into drivers who do not set aside money from their business account before paying themselves their “net profit”. Soon enough, operating in this manner will catch up to anyone. All it takes is a blown turbo, one bad injector, or blown tire to wipe out a trucking business operating with no emergency buffer. If a $1000 setback could do this to an unprepared owner-operator, imagine what a $3000 set of drive tires or $3000 quarterly tax estimate might do!

One major key to succeeding is identifying, planning for, and managing large expenses. These expenses come in two general forms of those that you know an exact date you will incur them and the other category of “surprise” expenses. Even though I label one category as “surprise” expenses, you can be certain many of these surprises can be planned for ahead of time as well. Knowing exactly what your expenses are and being prepared for them can easily mean the difference between success and belly-up. It is all too often I run into drivers who do not set aside money from their business account before paying themselves their “net profit”. Soon enough, operating in this manner will catch up to anyone. All it takes is a blown turbo, one bad injector, or blown tire to wipe out a trucking business operating with no emergency buffer. If a $1000 setback could do this to an unprepared owner-operator, imagine what a $3000 set of drive tires or $3000 quarterly tax estimate might do!

Drivers that operate without knowing exactly what their expenses are can usually plan on ending up on the negative side of a trucking statistic. A hands-on owner-operator should have the basic knowledge of what it takes to run a truck and be able to plan ahead for these types of “surprise” expenses. Historically, I have learned to set aside a minimum of 10% of my gross earnings in a separate buffer account to plan for these exact types of maintenance expenses, which of course will vary for you based on your particular operation. At first an amount that size can seem like a large part of what you thought was your "profit" if you are not used to setting funds aside in this way. However, when the time comes that you actually need it, you will be more than glad it is there to rescue your behind! After all, "He who fails to plan is planning to fail." (Winston Churchill).

Drivers that operate without knowing exactly what their expenses are can usually plan on ending up on the negative side of a trucking statistic. A hands-on owner-operator should have the basic knowledge of what it takes to run a truck and be able to plan ahead for these types of “surprise” expenses. Historically, I have learned to set aside a minimum of 10% of my gross earnings in a separate buffer account to plan for these exact types of maintenance expenses, which of course will vary for you based on your particular operation. At first an amount that size can seem like a large part of what you thought was your "profit" if you are not used to setting funds aside in this way. However, when the time comes that you actually need it, you will be more than glad it is there to rescue your behind! After all, "He who fails to plan is planning to fail." (Winston Churchill).