For an owner-operator who wants to grow a successful business, there are benefits to forming a Limited Liability Companies (LLC). An LLC can offer liability protection for the members. It also allows members to avoid the taxation of a corporation. By forming an LLC the members can be protected from liabilities or judgments against the LLC. An LLC formed with only one member will be taxed as a sole proprietorship while LLC’s formed with multiple members will be taxed as a partnership. Both options will avoid the double taxation attributed to a c-corporation.

After forming an LLC, the business will have the option to be taxed as either a c-corporation or an s-corporation. By electing to be taxed as a c-corporation the business would be required to pay corporate income taxes and the shareholders would be required to pay individual income taxes on the dividends that are distributed by the LLC. This is known as “double taxation.”

A more common election for an LLC will to be taxed as an s-corporation. The s-corporation is considered a pass-through entity. The income is not taxed at the corporate level and the profits are distributed to the shareholders who pay the taxes at the individual level. The individuals are responsible for paying income taxes but they do not pay self-employment (Social Security and Medicare) taxes on the distribution.

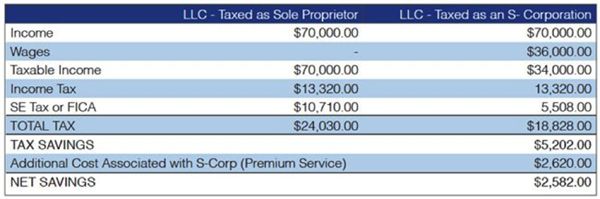

Depending on the level of income it may be a tax advantage for an LLC to be taxed as an s-corporation. However, if that income level is not high enough, an LLC being taxed as an s-corporation can cost more than the savings in taxes. A general rule of thumb that ATBS suggests is if the business will produce a net income of $70,000/year or more there can be some tax savings being taxed as an s-corporation. This chart compares the taxes for an LLC taxed as a sole proprietorship and an LLC taxed as an s-corporation:

If you are ready to consider incorporation, call a trucking business services provider such as ATBS. ATBS offers owner-operators incorporation, tax, and accounting services.

Also, watch the Owner-Operator Incorporation webinar for more information on how to choose which business structure is best for you.