Leading up to the ELD mandate on Dec. 18, 2017, some industry observers had predicted a mass exodus of trucks from the industry. But that hasn't happened, at least not yet. According to data from the U.S. Department of Transportation, the number of active carriers has actually ticked up slightly since ELDs became mandatory. There was just under a 1% increase in active carriers between December 18, 2017 and February 18, 2018.

A few months before the mandate went into effect, a DAT survey revealed that 30% of respondents, mostly owner-operators, said they planned to leave the industry rather than implement ELDs. Last week, DAT re-surveyed that same group and found that 91% of respondents have implemented ELDs. Of the group that had not yet implemented ELDs, more than half were exempt from the mandate.

The big question is, how many carriers will drop out of the industry after April 1, when trucks without ELDs will be put out of service?

ELD's Impact on Trucking

Even though the number of active carriers has not dropped since December, the ELD mandate has certainly had an impact on the trucking industry. Here's how:

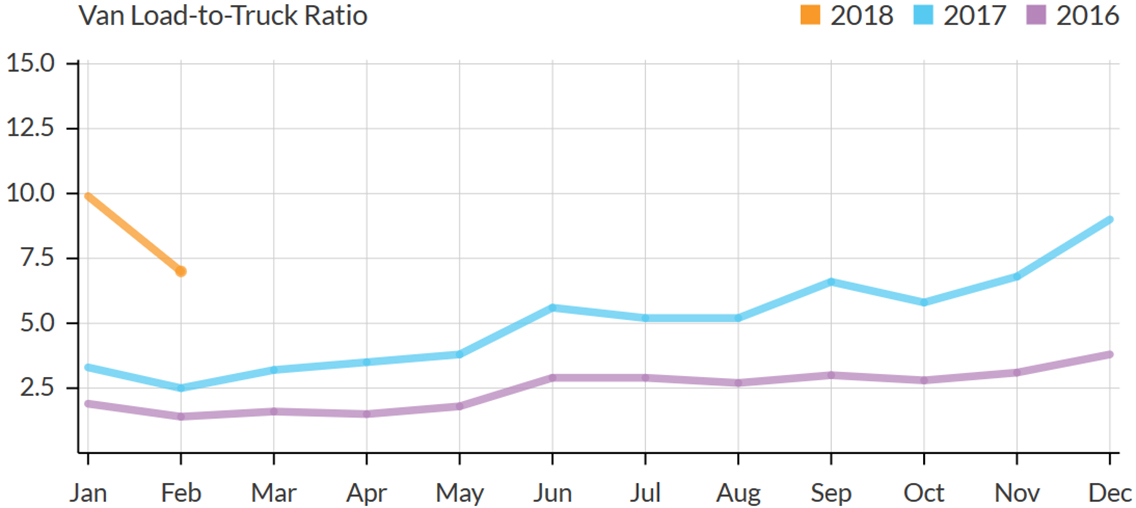

Reduced capacity - In the first full month following the ELD mandate, January 2018, load-to-truck ratios — a measure of supply and demand — hit record highs. For vans, the load-to-truck ratio hit 9.9 in January, meaning there were almost 10 load posts for every truck posted on DAT load boards. That was 3 times higher than the previous January.

.jpeg.aspx?width=500&height=223)

Record-high rates - Rates also jumped to record highs in the first weeks following the ELD mandate. However, at the time it was hard to tell if rate increases were due to the mandate or to other factors, such as last-minute holiday and e-commerce deliveries, severe winter weather in many part of the country, or fewer trucks available as drivers took time off for the holidays, or some combination of reasons.

By February, those factors had worked their way through the system, but van rates were still 32% higher than in the previous year. And February's high rates didn't appear to be the result of increased demand. There were more loads offered on DAT load boards, but data from DAT RateView shows no dramatic increase in the number of spot market loads that actually moved in February 2018, compared to February 2017.

Decreased productivity - Carriers who stayed in the industry and adopted ELDs were met with new challenges. For example, what previously was a one-day trip may have turned into a two-day trip when the driver ran out of hours, because ELDs lack the flexibility of paper logs.

Less patience for sluggish shippers - Another outcome of the ELD mandate has been increased impatience with shippers and receivers who detain carriers at the docks. A recent article in American Trucker noted that for the past 4 to 5 years, shippers have had the upper hand. But now, "ELDs are changing the economics of trucking in such a way that the smart carriers who really understand their costs are just saying: I can't do this. I can't wait five hours to be loaded."

Freightliner’s Team Run Smart is partnering with DAT to offer a special on the TruckersEdge load boardto its members. Sign up for TruckersEdge today and get your first 30 days free by signing up at www.truckersedge.net/promo717 or entering “promo717” during sign up.

* This offer is available to new TruckersEdge subscribers only

About TruckersEdge®, powered by DAT®

TruckersEdge® Load Board is part of the trusted DAT® Load Board Network. DAT offers more than 68 million live loads and trucks per year. Tens of thousands of loads per day are found first or exclusively on the DAT Network through TruckersEdge.

This article was originally featured on DAT.com.