One of the biggest misconceptions I come across in tax planning with my clients is that self-employment (SE) taxes (social security and Medicare) and income taxes are calculated on the same line of the tax return. The thought is, if I have a $5,000 tax bill, I can just spend $5,000 on my truck as business expense and pay no taxes! That’s incorrect. In reality, business expenses only reduce your tax liability by 15-30 cents on the dollar (see effective tax rate below). Also SE tax and income taxes are the only two forms of taxes a sole proprietorship and single member LLCs are liable for on a Federal 1040/Schedule C return as far as business income goes. IRS considers these forms of business as “flow-thru” entities; meaning all income from the business filters down to your individual marginal tax rates and will not be subject to “double taxation” at a corporate/business level.

One of the biggest misconceptions I come across in tax planning with my clients is that self-employment (SE) taxes (social security and Medicare) and income taxes are calculated on the same line of the tax return. The thought is, if I have a $5,000 tax bill, I can just spend $5,000 on my truck as business expense and pay no taxes! That’s incorrect. In reality, business expenses only reduce your tax liability by 15-30 cents on the dollar (see effective tax rate below). Also SE tax and income taxes are the only two forms of taxes a sole proprietorship and single member LLCs are liable for on a Federal 1040/Schedule C return as far as business income goes. IRS considers these forms of business as “flow-thru” entities; meaning all income from the business filters down to your individual marginal tax rates and will not be subject to “double taxation” at a corporate/business level.

Calculation of SE Tax and Income Taxes

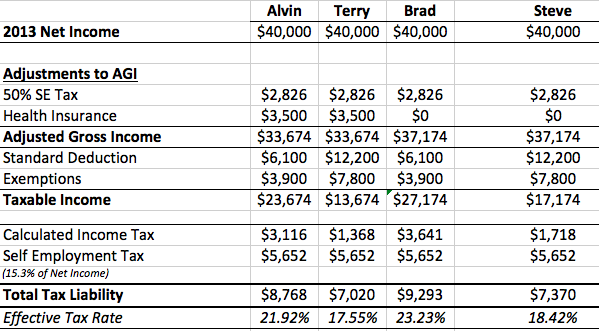

Let’s compare four owner-operator scenarios for 2013 rates:

- Alvin: Single Sole Proprietor who made $40,000 net income after business expenses and paid $3,500 in health insurance.

- Terry: Married Sole Proprietor making same as Alvin and paying same in health insurance and no spousal income.

- Brad: Same as Alvin but no health insurance

- Steve: Same as Terry but no health insurance

*Assuming no state income taxes such as TX or FL

*Assuming no state income taxes such as TX or FL

(Calculated income tax is based on 2013 tax tables issued by the IRS from taxable income line.)

The above diagram is in chronological order just like a 1040 Tax Return to show how the calculations flow. Terry and his spouse will pay the least due to the health insurance and married filing jointly standard deduction. But all four owner-operators pay the same SE tax because it’s calculated solely off of business income, not adjustments, exemptions or any qualifying credits.

Remember business expenses are not one-to-one write offs!

Remember business expenses are not one-to-one write offs!

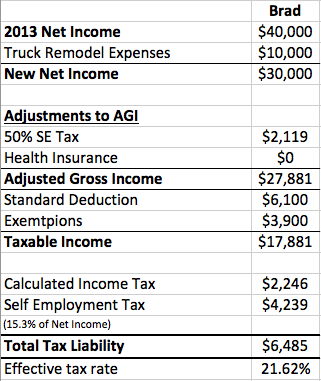

Brad just got off the phone with his tax preparer in late December 2013 and the preparer estimated he should expect around $9,500 (see above example) in taxes to be owed. Brad is considering ways to wipe out his tax liability that will be due April 15th. He decides to go out and spend $10,000 on December 31st on a chrome kit, new seats, tires, new paint job, etc. He figures, “I might as well put the money in the truck rather than in Uncle Sam’s hands!” Brad submits his receipts for these purchases to his tax preparer. Come early April, Brad gets a call from the preparer and is notified of the results as shown in the chart to the right:

The preparer explains to Brad that the business expenses effectively reduced his tax liability twenty eight cents for every dollar he put into the truck remodel. So instead of Brad paying the $9,239 in taxes for the year, he is out of pocket for a total of $16,485 for taxes and remodel.

Brad would be better off using his income to purchase health insurance rather than spending his income on business expenses to lower his tax liability. He should go after one-to-one write offs that reduce your adjusted gross income such as: health insurance, 50% SE tax, self-employed IRAs, student loan interest, and health savings accounts to name a few. Health insurance is not a business expense (as a Sole Proprietor/LLC) and for good reason, otherwise it wouldn’t be as valuable of a deduction as it is now. So it is in Brad’s best interest to purchase health insurance for it’s tax incentives.

Tax Planning for Future Years

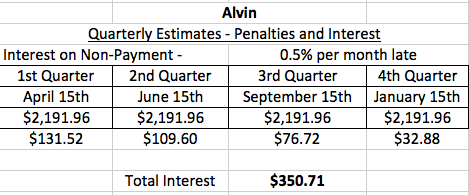

Usually, good tax methods can help save 20-25% of your income to satisfy tax liability (depending on your situation). Paying quarterly taxes on time will ensure no penalties or interest accrues on your tax liability. Take Alvin’s scenario for example if he didn’t pay quarterly:

*$2191.96 is Alvin’s 2013 tax liability divided by four. He should pay these for 2014 (safe harbor estimates) if he estimates income will be consistent with 2013.

The key is to be vigilant in planning for taxes, identify what types of expenses you can leverage as one-to-one deductions to lower your tax liability, and pay quarterly estimates to minimize penalties.