The #1 challenge for owner-operators today is how to keep more of their hard-earned money. We’d like to tackle this problem by listing four key steps that help owner-operators hold onto the revenue they generate.

Before looking at your expenses, you will need to understand them fully. Look at your expenses over the past 60 to 90 days. If you receive a profit and loss statement through a company such as ATBS, this tool will serve as your expense road map. If you don’t, you will need to calculate every expense in your business and personal life. Once you have a strong sense of the money coming in and going out the door, you can lower your expenses and increasing your profit.

Step 1: Personal Expense Allocation

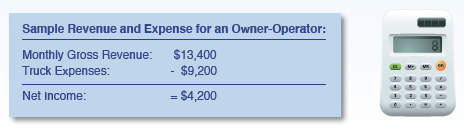

Your first expense strategy is to identify the total funds you have each month after you’ve paid your truck expenses. A typical owner-operator will have gross revenue in the range of $13,400 a month and truck expenses of $9,200 per month, leaving a net income of $4,200 a month.

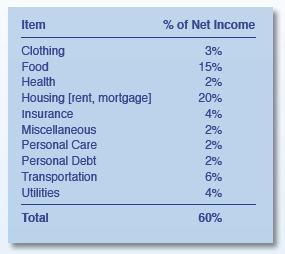

Owner-operators should to allocate approximately 60% of their net income for all personal expenses. If you exceed 60%, then you might need to review your list of personal expenses and cut back. Your personal expense breakdown should look something like this:

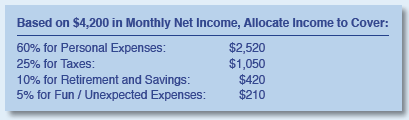

Step 2: Cover Taxes and Retirement – Then Have Fun

The next step is to divide the remaining 40% of your net income into three areas including; 25% for Tax Estimates,10% for Retirement and 5% for Fun and Unexpected Expenses. If you have the discipline, remain committed to saving as much as possible by maximizing the retirement bucket whenever possible. It is remarkable how quickly you can reach retirement goals by putting away as much money as you can early in life. One tool to help you understand the importance of starting early is the Charles Schwab Retirement Calculator. This online tool allows you to input the age you start setting money aside, the amount of money put aside, the estimated age of retirement, and more.

Step 3: Tend Your Financial Garden

Understanding your expenses is not an annual task; it’s a task that should be addressed every month if possible. Here is a list of the biggest expense areas that are opportunities for an owner-operator to consider:

1. Credit Card Debt - If you have credit card debt, consider paying it as soon as possible. Credit cards are good cash management tools but they are typically one of the worst ways to rack up debt because of high interest rates. A monthly credit card bill includes information on how long it will take you to pay off your balance if you only make minimum payments. It also tells you how much you would need to pay each month in order to pay off your balance in three years.

2. Extra Cars - Does your family have more than one car? If there are extra or unused cars and trucks in your driveway, consider selling them immediately especially if you are making a payment; not only will you save on car payments but you will save on car insurance, taxes and gas purchases.

3. Luxury Expenses - One of the “low hanging fruits” in your financial garden is the “Entertainment and Food” expense. Decide to eat at home more often and find entertainment that does not cost a lot. You’d be surprised to find that most public museums, zoos and art houses offer “free days” throughout the year. If you must see a movie, try renting from a kiosk such as Redbox or consider the cheaper afternoon matinee.

4. Unnecessary Expenses - Review your housing expenses and look for unnecessary expenditures such as cable TV, home phone, and Starbucks coffees. Consider calling the competition to ensure you are getting the best rate possible.

5. Comparison Tools - Be vigilant with your Smartphone bill and your insurance bills. It’s no cost to inquire and some Internet sites make comparing fast, and easy. Here are two popular online price comparison tools: My Rate Plan and esurance.com

Step 4: Fuel Expenses

Owner-operators face high fuel expenses and we’ve compiled some ways to save money on fuel:

1. Use your carrier’s fuel network.

2. For your personal or family gas expense, use GasBuddy, which is a free Smartphone application that finds the cheapest fuel costs in your area; we’ve tested the app and it’s good enough to shave some dollars off your monthly fuel expense.

3. Find new ways to increase your truck’s MPG. Some people dedicate their lives to blogging about truck fuel efficiency. One person you might want to follow for new tips is Henry Albert, Team Run Smart pro who is achieving over 9 MPG.

Owner-operators live with the day-to-day challenge of rising costs. This means today’s owner-operators needs to continually focus on ways to be smart with their money. From expenses at home to fuel expenses on the road, each expense is an opportunity to either save money or waste money.

ATBS business consultants know the trucking industry, and are available to help owner-operators find ways to improve their profitability.