Almost every driver begins their career as a company driver and they learn early to get a cash advance against their future paycheck. That’s not always a terrific idea for company drivers because cash in the pocket is not the same thing as money in the bank, or money going home.

When a company driver gets a cash advance, the amount of that advance flows through to their weekly paycheck where all deductions are taken from the gross earnings. A couple of typical deductions are for the advance and also for income taxes. Gross income minus all deductions is the take home pay.

The next time at the truck stop or discount store make a mental note of all the things that are set up to tempt impulse buying. The marketing teams for these places are really good at their job – with big ticket items on the way in and little ticket items on the way out. A driver can be pinched by a little paycheck when a cash advance can end-up in someone else’s pocket.

Like a company driver, advances are deducted from the owner-operator’s settlement but unlike the  company driver taxes are not deducted from the settlement. Self-employed Owner-operators are responsible for managing their own taxes. That’s where the trouble with cash advances and quarterly taxes can begin. Differences between the total cash advance and the sum of all business receipts is called income by the IRS. And if there is income you know what the IRS wants – they call it income tax and they want part of your income.

company driver taxes are not deducted from the settlement. Self-employed Owner-operators are responsible for managing their own taxes. That’s where the trouble with cash advances and quarterly taxes can begin. Differences between the total cash advance and the sum of all business receipts is called income by the IRS. And if there is income you know what the IRS wants – they call it income tax and they want part of your income.

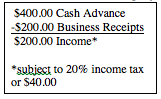

It looks like this. Let’s say that a $400 cash advance was taken but there is only $200 in business receipts. The remaining $200 is called income and the IRS requires that they be paid 20 - 25% of that income or $40 - $50. You have to repay the full $400 advance right away, but now there is a hidden debt to the IRS. If that is done 40 times in a year that’s an invisible debt to the IRS of up to $2,000. Income taxes are due April 15th, which can make this story even worse.

April 15th is the worst possible time of the year for a trucker to come up with cash. In the winter months prior to April 15th operating cost increases and revenue decreases. Spendable income is less and it can be hard to make ends meet in January, February, and March. April comes along with a glimmer of daylight but by April 15th the invisible debt to the IRS is no longer invisible. Advances not offset by business receipts will be taxed as income. In this situation, the year-end tax bill makes it rough on an owner-operator who hasn’t planned ahead.

Two things to do to get ahead of this:

- Take cash advances for business reasons only. That means have business receipts that offset the full amount of the cash advance. If cash advances are needed for personal food its best to make that very temporary. Stop that situation and don’t get back into it. Remember meals and incidentals are not business receipts but the daily per-diem deduction is a good deal for drivers. Don’t throw away this good deal by taking advances for food because of the hidden tax on that advance that might come due at a bad time.

- Pay Quarterly Tax Estimates on time. With enough time anyone can eat an elephant just one bite at a time. It’s the same with taxes. Pay quarterly taxes on time or risk trouble. April 15th is the worst time to try to find the money to pay the full tax bill.