Spot market volumes hit an all-time high on the top 100 van lanes two weeks ago. Rates rose on 66 of those lanes, and the national average van rate of $1.94 per mile is 16¢ higher than it was for the month of August.

A lot of this can be attributed to the supply chain disruptions caused by Hurricanes Harvey and Irma, plus the uptick in fuel costs that followed. But so far, truckload capacity hasn't shown many signs of loosening, so prices have stayed elevated even after the initial spikes in rates caused by the storms.

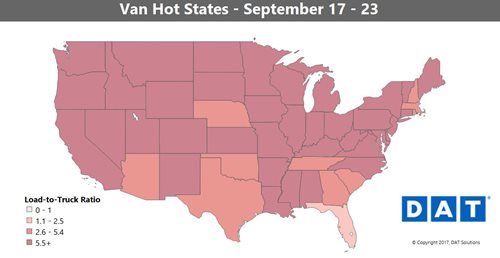

Just look at all the dark red in this Hot States Map from the week of September 17:

Volumes soared 52% out of Atlanta, a combination of emergency freight heading into Florida and pent-up demand from shipments that were delayed by Irma. Volumes also rose significantly in Charlotte.

Rates out of Texas were down last week, but outbound averages in both Dallas and Houston remain higher than they were before Hurricane Harvey hit, almost 5 weeks ago.

Rates below include fuel surcharges and are based on real transactions between carriers and brokers.

RISING LANES

Every major van market got a boost to outbound rates in September. Prices rose the most out of Columbus and Buffalo, with significant increases on 4 major lanes out of Buffalo. In just one week:

- Buffalo to Chicago lane rates rose 35¢ to an average of $1.97/mile

- Buffalo to Charlotte climbed 34¢ to $2.44/mile

- Buffalo to Columbus was also up 31¢ to $2.21/mile

- Buffalo to Allentown, PA, added 27¢ at $2.37/mile

The patterned continued on eastbound lanes, as well as north-south lanes, heading to Atlanta:

- Chicago to Columbus rose 30¢ to $3.30/mile

- Columbus to Atlanta gained 32¢ at $2.99/mile

- Philly to Atlanta also added 34¢ for an average of $2.05/mile

FALLING LANES

Rates spiked after Hurricane Irma, and some came back down last week.

- Charlotte to Lakeland, FL fell 24¢ but was still high at $3.08/mile

- Same thing with the Atlanta to Lakeland lane, down 22¢ to $3.43/mile

- In the other direction, prices on the lane from Atlanta to Philadelphia fell 20¢ to $2.31/mile, balancing the increase in demand for the southbound route

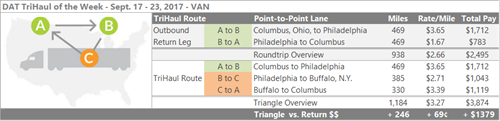

For carriers, the higher prices out of Buffalo also create opportunities for triangular routes that can boost your revenue. For example, if you’re already taking advantage of the high rates for van loads going from Columbus to Philadelphia, you can add a stop to Buffalo on the way back to take advantage of the high rates from Buffalo to Columbus.

Columbus to Philly averaged a whopping $3.65/mile last week. The return trip from Philly to Columbus averaged $1.67, which still makes for a good roundtrip. If you can do it in two days, go for it. If not, you can earn more by taking that load from Columbus to Philadelphia and then a second load from Philadelphia to Buffalo. The van rate on that lane was $2.71 last week. The third and final leg, from Buffalo back to Columbus, averaged $3.39/mile. Compared to the straight there-and-back, this TriHaul adds about 250 miles, not counting deadhead, but it also boosts your revenue by nearly $1,400, so you’ll make almost $3,900 on the 3-day trip. That’s a 51% higher than the original roundtrip revenue of $2,500.

Of course, you can negotiate, and maybe you’ll do even better. These are the average rates for the past 7 days, but every haul is different.

Freightliner’s Team Run Smart is partnering with DAT to offer a special on the TruckersEdge load boardto its members. Sign up for TruckersEdge today and get your first 30 days free by signing up at www.truckersedge.net/promo717 or entering “promo717” during sign up.

* This offer is available to new TruckersEdge subscribers only

About TruckersEdge®, powered by DAT®

TruckersEdge® Load Board is part of the trusted DAT® Load Board Network. DAT offers more than 68 million live loads and trucks per year. Tens of thousands of loads per day are found first or exclusively on the DAT Network through TruckersEdge.

This article was originally featured on DAT.com.