Did you know owner-operators can deduct the full purchase price of most equipment and/or software purchased or financed during the tax year for their business? Section 179 of the IRS tax code allows businesses to that buy (or lease) a piece of qualifying equipment, to deduct the full purchase price from your gross income. It's an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Several years ago, Section 179 was often referred to as the "SUV Tax Loophole" or the "Hummer Deduction" because many businesses have used this tax code to write-off the purchase of qualifying vehicles at the time (like SUV's and Hummers). But, that particular benefit of Section 179 has been severely reduced in recent years, see 'Vehicles & Section 179' for current limits on business vehicles.

Today, Section 179 is one of the few incentives included in any of the recent Stimulus Bills that actually helps owner-operators. Although large businesses also benefit from Section 179 or Bonus Depreciation, the original target of this legislation was much needed tax relief for small businesses - and millions of small businesses, including owner-operators, are actually taking action and getting real benefits.

How does Section 179 work?

When your business buys certain items of equipment, it typically gets to write them off a little at a time through depreciation. In other words, if you spend $120,000 on a truck, you get to write off (say) $25,000 a year for five years (these numbers are only meant to give you an example). Now, while it's true that this is better than no write off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

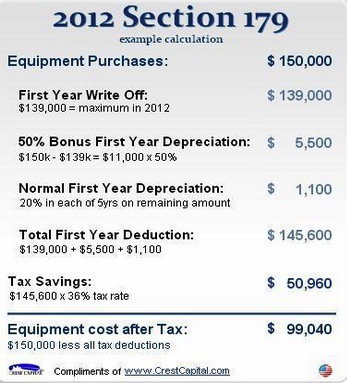

In fact, if a business could write off the entire amount, they might add more equipment this year instead of waiting over the next few years. That's the whole purpose behind Section 179 - to motivate the American economy (and your business) to move in a positive direction. For most small businesses (adding total equipment, software, and vehicles totaling less than $139,000 in 2012), the entire cost can be written-off on the 2012 tax return.

Limits of Section 179

Section 179 does come with limits - there are caps to the total amount written off ($139,000 in 2012), which is close to or right at what a new truck can cost, and limits to the total amount of the equipment purchased ($560,000 in 2012). The deduction begins to phase out dollar-for-dollar after $560,000 is spent by a given business, so this makes it a true small and medium-sized business deduction.

Do you qualify for Section 179?

All businesses that purchase, finance, and/or lease less than $560,000 in new or used business equipment during tax year 2012 should qualify for the Section 179 Deduction. If a business is unprofitable in 2012, and has no taxable income to use the deduction, that business can elect to use 50% Bonus Depreciation and carry-forward to a year when the business is profitable.

Most tangible goods including "off-the-shelf" software and business-use vehicles (restrictions apply) qualify for the Section 179 Deduction. For basic guidelines on what property is covered under the Section 179 tax code, please refer to this list of qualifying equipment. Also, to qualify for the Section 179 Deduction, the equipment and/or software purchased or financed must be placed into service between January 1, 2012 and December 31, 2012.

The deduction begins to phase out if more than $560,000 of equipment is purchased - in fact, the deduction decreases on a dollar for dollar scale after that, making Section 179 a deduction specifically for small and medium-sized businesses. However, as noted above, large businesses can expense all qualifying capital expenditures with 50% Bonus Depreciation for the 2012 tax year.

What's the difference between Section 179 and Bonus Depreciation?

What's the difference between Section 179 and Bonus Depreciation?

The most important difference is both new and used equipment qualify for the Section 179 Deduction (as long as the used equipment is "new to you"), while Bonus Depreciation covers new equipment only. Bonus Depreciation is useful to very large businesses spending more than $560,000 on new capital equipment in 2012. Also, businesses with a net loss in 2012 qualify to deduct some of the cost of new equipment and carry-forward the loss.

When applying these provisions, Section 179 is generally taken first, followed by Bonus Depreciation - unless the business has no taxable profit in 2012 because the unprofitable business is allowed to carry the loss forward to future years.

Section 179's "More Than 50 Percent Business-Use" Requirement

The equipment, vehicle(s), and/or software must be used for business purposes more than 50% of the time to qualify for the Section 179 Deduction. Simply multiply the cost of the equipment, vehicle(s), and/or software by the percentage of business-use to arrive at the monetary amount eligible for Section 179.

With the upcoming election this tax deduction could likely change for 2013. Take advantage of this tax deduction that benefits owner operators while you still can.