In today’s fast-paced world, it’s easy to get consumed with what is directly in front of us as opposed to thinking about the future. Because let’s face it, it’s way more exciting to talk about who won the game last night than it is to talk about your emergency fund or starting a retirement account. Am I right?

The good news is that setting yourself up for future financial success doesn’t need to consume much of your time. So if you happen to have a personality that would rather take a set-it-and-forget-it kind of financial approach, you’ll want to check out these top 10 tips to get your money moving in the right direction for the long haul.

Live Below Your Means

Living below your means is something your grandparents probably had down to a science. I’m not sure how or why it became so difficult in the past few decades, but it’s safe to say that keeping up with The Joneses has turned into a real problem in this country.

No judging going on here, I, too, fell into the trap of wanting bigger and better things than my neighbors. Eventually, though, when the debt load started to keep me up at night, I realized it was time to turn my finances around and start acting like an adult.

In fact, I used many of the tips outlined in this article to get my money back on track so that my husband and I could start building wealth instead of squandering it.

All that to say, take your grandparents advice - live below your means. Trust me, you’ll sleep better at night.

Invest In Yourself

Investing in yourself is one of the best money moves you can make at almost any age. By investing in yourself, you can learn a new skill or trade that will, in turn, provide you with an opportunity to make more money over the course of your lifetime.

It might seem like paying for extra classes or certifications is a waste of time and money, but the additional education or skill will likely be more than your competition has when it comes to applying for your next job. You never know, it could end up in higher rates.

I took advantage of my employer’s educational program to attain a higher degree and I haven’t been disappointed. It’s enabled me to qualify for different jobs within my company and would most certainly put me above the competition should I decide to explore outside my current company.

The more you invest in yourself, the more options you will have.

Increase Your Income

Increasing your income is something you may or may not need to do to build significant wealth. There are no two ways about it, cutting expenses and living a frugal lifestyle can really help in terms of freeing up money - but there is only so much that can be cut before you just need to earn more money.

The good news is that increasing your income might be easier than you think. It could be as easy as asking for a raise, taking on additional loads, or switching carriers.

I would recommend exploring all three options. Obviously, start with simply asking for an increase in rates. You just might get it without any hassle at all. In which case, problem solved.

Resist Lifestyle Inflation

This goes back to what grandma and grandpa used to tell you. Live below your means is the financial cousin of resisting lifestyle inflation.

These days, the more money people make, the more money they tend to spend. If you have the ability to increase your income without increasing your lifestyle, you have the option of investing the difference.

By investing the difference between income and expenses, you’ll be well on your way to building a healthy financial future.

Avoid Debt Or Eliminate It

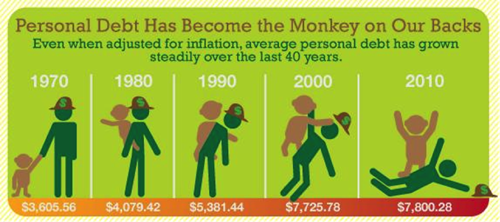

As you can clearly see from the infographic below, our personal debt load has more than doubled in the past four decades. When it comes to debt, avoid it whenever possible.

During times when it’s impossible to avoid, such as medical debt or borrowing a reasonable amount for continuing education, do your best to eliminate the debt as quickly as possible.

Building significant wealth is extremely difficult when you’re carrying a high debt load. Once again, take a page out of your grandparents’ playbook.

Image Credit: Forbes

Track Your Expenses And Spending

Tracking your expenses and spending is also known as budgeting. Budgeting can be as complicated or as easy as you’d like it to be.

Simply, keep track of all of your income and exactly what you’re spending that income on each month. Then, make a plan to allocate each dollar toward monthly expenses, debt repayment, and savings.

Hopefully, you’re not spending more than you’re earning. If so, you’re on a collision course with disaster, you’ll need to address it immediately unless you want a bankruptcy to be in your future.

Fortunately, we already covered some simple ways to increase income above. Utilize those strategies and cut back on monthly expenses to get your money turned around so you can start building wealth.

Automate Your Finances

Another piece of the wealth-building puzzle is to automate your finances. If you can automate money to be pulled out of your paycheck each month and stashed away in savings and/or investment accounts, you’re going to be much better off than someone without such a simple plan.

Don’t believe automating your finances can make that much of a difference? Well, if you’ve never read or heard of the the book, The Automatic Millionaire, I highly recommend you check it out.

Optimize Expenses

Optimizing your expenses is another way to increase your monthly cash flow in order to have more money to build wealth.

Ways to optimize your expenses include:

❏ Negotiating better rates on credit cards

❏ Reduce utility bills through conscious use

❏ Reduce cable and/or mobile data plans

❏ Shop around for the best price before making purchases

❏ Plan all purchases to avoid impulse buys

Invest For Your Future

After all the heavy lifting is done, meaning you’ve eliminated your debt, increased your income, optimized expenses, and have an emergency fund in place, it’s time to put your extra money to use by investing for your future.

Investing in your future could mean investing in a 401(k) plan, Individual Retirement Account (IRA), and/or real estate. As with any investment vehicle, make sure you do due diligence before putting your hard-earned money into something you don’t understand.

I would recommend consulting with a trusted financial professional to make sure you understand the options based on your time horizon and future goals.

Track Your Net Worth

Last but not least, one of the best things you can do today to start building wealth is to track your net worth. Your net worth is your Total Assets - Total Liabilities. This easy calculation gives you a quick snapshot of your finances and lets you know how you’re doing for your income level and age.

Tracking our net worth was the absolute best thing we ever did to keep us motivated to pay down debt and continue investing for our future.

To learn about net worth and why it matters, visit Investopedia for more information.

So whether you’re in your 20s, 30s, 40s, or beyond, implementing a few of these money tweaks will do wonders for your peace of mind and bottom line. Never underestimate the power of taking action, no matter how small your initial steps may be.