In my last blog post, I discussed how many carriers and owner operators have been using the fuel surcharge as a profit center. Now that fuel prices are on the decline, this scenario will change how the scales balance out between productivity and efficiency. As the fuel price drops so does the opportunity to profit. Emphasis on fuel mileage should never go away especially if we want to keep fuel prices low. If all of us abandoned our fuel efficiency efforts, the demand for diesel fuel would sky rocket. From what I’ve been reading, it appears that fuel prices are going to remain low for quite a period of time. I am old enough to have lived through the many fluctuations in the market causing prices to rise or lower in cost. It seems that each time we let our guard down, fuel prices rise when we least expect it and catch businesses and people alike off guard.

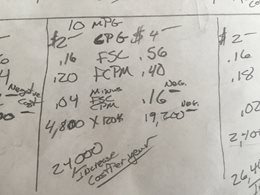

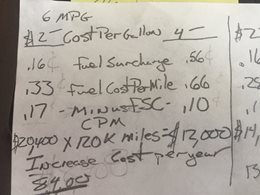

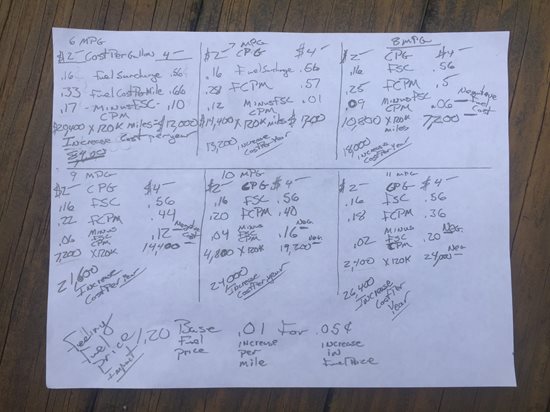

Below, you can review where I did some figuring to analyze how lower fuel prices were going to affect my bottom line. I decided to get out my handy pencil and some paper and actually physically write

down the calculations. This helps me to keep the figures fresh in my mind for when I need to make a quick decision regarding my business. What I found at first was more discouraging than I originally thought. The 10 mpg truck would cost $24,000 more to operate at $2.00 per gallon than at $4.00 per gallon. For the calculation, I used a fuel price base of $1.20 per gallon with an increase of 1 cent for each 5 cent increase in fuel price. This worked out to a fuel surcharge of 56 cents per mile. At $4.00 a gallon, the fuel cost per mile would be 40 cents per mile which would make the fuel cost be a negative 16 cents per mile. This would result in a fuel cost after fuel surcharge of being a negative $19,200 based on 120,000 mile year. With a fuel price of $2.00 per gallon, the same truck would receive a 16 cent fuel surcharge and a fuel cost per mile of 20 cents per mile. This equates to a 4 cent per mile fuel cost above the fuel surcharge at $4,800 for the same 120,000 miles driven. Being you were at a negative fuel cost above fuel surcharge at $4.00 a gallon and a positive fuel cost per mile at $2.00 a gallon, you would add the $4,800 to the $19,200 negative and you get a negative $24,000 change to bottom line per year.

When you look at the 6 mile per gallon truck, the increased cost per year is only $8,400 using the same calculations. You must keep one factor in mind, the 6 mile per gallon truck was never able to turn fuel surcharge into a profit center to begin with. At $2.00 per gallon, it cost 33 cents per mile for fuel. The 10 mpg truck, meanwhile at the same price is 20 cents per mile which adds up to 13 cents per mile less. Based on the same 120,000 mile year, it’s still a $15,600 change in cost of operation.

To Keep the calculations simple for illustration purposes there are no deadhead miles and figures are based on the truck getting paid for all miles driven by the odometer. I realize we are not paid in this manner however this is just for basic planning. The scenario gets more involved as you plug in more of your own data. Next, I will go over how speed can affect your bottom line as well.

|

|

Working on a strategy for 2016 at the park picnic table . |